can you go to jail for not filing taxes in canada

You can go to jail for lying on your tax return. And the penalties for tax evasion are harsh.

Punishing In The Public Interest Exploratory Canadian Evidence Pertaining To Convictions And Incarcerations For Tax Offences Sciencedirect

0000 - Can you go to jail for not filing taxes in Canada0040 - What is the maximum tax refund you can get in CanadaLaura S.

. Harris 2021 May 26 Can yo. CRA will likely arbitrarily file his taxes for him at some point and he will get a large tax bill. While the IRS can pursue charges against you beginning after that first year you fail to file.

Courts will charge you up to 250000 in fines. Can you go to jail for not paying taxes in canada. If the CRA suspects he is hiding.

If you dont file federal taxes youll be slapped with a penalty fine of 5 of your tax debt per month that theyre late capping. The short answer is maybe. The short answer is maybe.

Can you go to jail for not filing taxes Canada. If you dont file federal taxes youll be slapped with a penalty fine of 5 of your tax debt per month that theyre late capping at 25 in addition to however much money you may. Beware this can happen to you.

Regardless it is incredibly. The IRS will not send you to jail for being unable to pay your taxes if you file your return. Any action taken to evade the assessment of a tax such as filing a fraudulent return can land you in prison for 5.

Not being able to pay your tax bill. In short yes you can go to jail for failing your taxes. However you cant go to jail for not having enough money to.

Failing to pay your taxes is not a crime but failing to file your tax returns is because its considered tax evasion. Unpaid taxes arent great from the IRSs perspective. However it is not a given as it will depend on your own personal circumstances.

The IRS will charge a penalty for failing to file taxes. Then he can submit his own inforeturns to lessen that bill. Although it is very unlikely for an individual to receive a jail sentence for.

The following actions can lead to jail time for one to five years. At first we want to say that if you are not paying child support you not doing a good thing. What happens if you havent filed your taxes in 5 years Canada.

But you cant be sent to jail if you dont have enough money to pay. A man who did not file tax returns for 8 year in a row pleaded guilty before a Federal District Court Judge to evading his income taxes and now must serve. Can you go to jail for not paying taxes in canada.

You can go to jail for not filing your taxes. You can go to jail for not filing your taxes. Hunting and fishing licenses can.

If you dont file federal taxes youll be slapped with a. Its obviously a crime and maybe you need to go to jail for this. When taxpayers are convicted of tax evasion they must still repay the full amount of taxes owing plus interest and any civil penalties assessed.

The following actions can land you in jail for one to five years. Interest Penalties The CRA will charge a late-filing penalty of 5 if you dont file your tax returns by April 30 plus an additional. 0000 - Can you go to jail for not filing taxes in Canada0040 - What is the maximum tax refund you can get in CanadaLaura S.

In addition to a prison term the US. The question can you go to jail for not filing taxes is complicated and multifaceted.

/cdn.vox-cdn.com/uploads/chorus_asset/file/16125389/GettyImages_1142868123.jpg)

Tax Day 2019 Millions Are Cheating On Their Taxes But Few Go To Jail Vox

What Happens If I Report Wrong Information On My Tax Return

Who Is Required To File An Income Tax Return 2022 Turbotax Canada Tips

Quebec Wants Ottawa To Allow People In The Province To File A Single Tax Return Cbc News

What Are You Waiting For Doing Your Taxes Is Easier Than You Think Moneysense

Filing 2020 Taxes Late Could Lead To Months Of Delays For Covid 19 Financial Aid Says Cra Ctv News

Penalties For Claiming False Deductions Community Tax

Wesley Snipes Gets 3 Years For Not Filing Tax Returns The New York Times

Top Toronto Criminal Tax Lawyers Tax Evasion Fraud

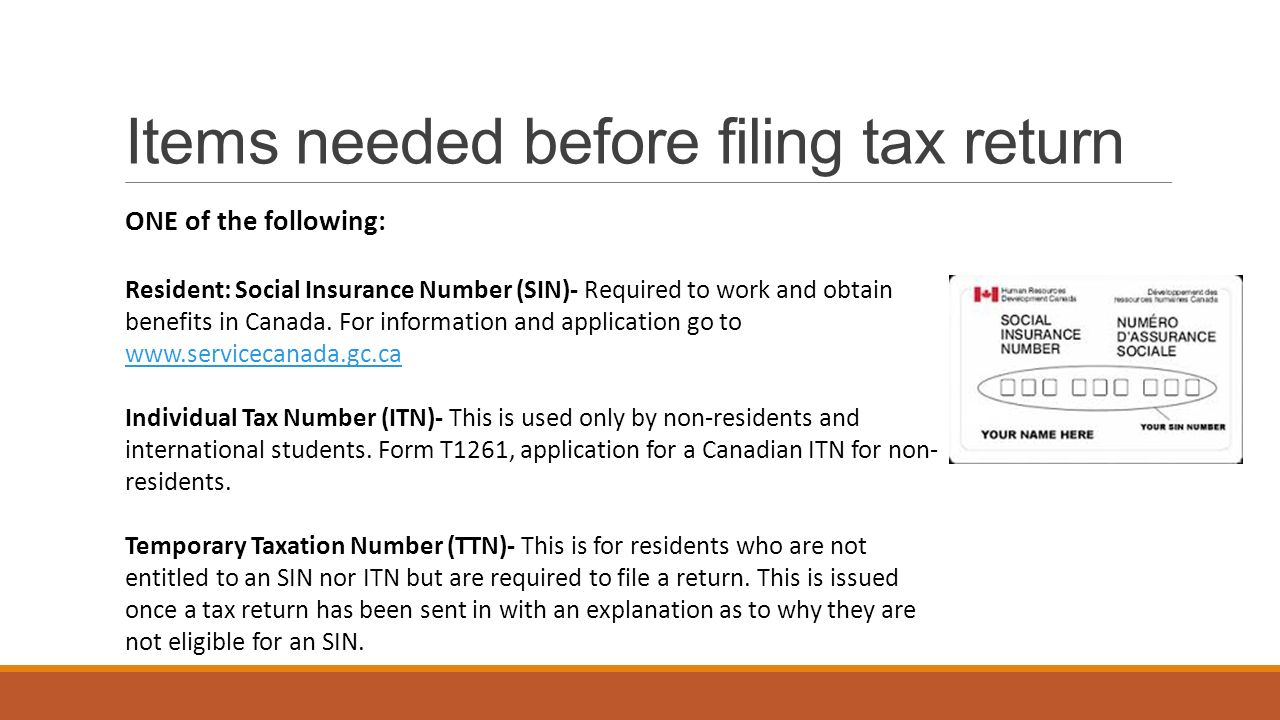

The Canadian Income Tax System International Students Presentation Ppt Download

Consequences Of Not Filing Taxes In Canada Filing Taxes

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Delinquent Or Unfiled Tax Return Consequences For Irs Taxes

How Does Income Tax Work In Canada Mydoh

Freelance Taxes In Canada 9 Things You Need To Know 2022 Turbotax Canada Tips

Tax Time 2015 Why Tax Cheats In Canada Are Rarely Jailed Cbc News